Atm Should Extract Money From Checking Or?

Hindi: आप इस लेख को हिंदी में भी पढ़ सकते है|

Bengali: এই ব্লগটি এখানে বাংলায় পড়ুন।

Need to withdraw money from ATM? When it comes to the easiest way to withdraw cash, a pocket-size cabin with a machine inside it, called an Automated Teller Machine (ATM), can exist the all-time solution.

The corresponding banks where we have our depository financial institution accounts provide us with an ATM cum debit card to withdraw greenbacks easily from ATM.

| Table of Contents |

|---|

| What is an ATM? |

| Types of ATMs |

| What is the structure of an ATM Motorcar? |

| How to withdraw money from an ATM? |

| Bottomline |

What is an ATM?

An Automated Teller Machine is an electronic banking machine that allows a bank account holder to perform bones money transactions, like withdrawing cash, without any other homo presence.

Apart from withdrawing cash, ATMs have begun to offer a plethora of useful services like –

- Open or withdraw a fixed deposit;

- Apply for loans;

- Pay insurance premium;

- Pay utility bills;

- Deposit checks and cash, etc.

Apart from these services, depending on the location and bank, each ATM offers a combination of various services apart from the basic withdrawal of cash.

While an ATM has get a familiar term, the usage of this machine is still a confusing task for many, especially in rural areas, where financial inclusion is still a new concept.

In this article, we have explained the basics of an ATM, followed past the simple procedure of how to withdraw money from an ATM so that one tin can be well aware of the withdrawal process.

Types of ATMs:

All ATMs are mainly of two types – on-site and off-site.

On-site ATMs are those which are available within a banking concern's compound, whereas an off-site ATM is located in other places, without the presence of a banking company branch.

Other than this, ATMs are differentiated on the basis of their origin and purpose. These include –

one. White Label ATMs:

These are set upwards and operated by Non-Banking Financial Companies (NBFCs) and offering the near popular ATM services.

2. Yellowish Label ATMs:

These ATMs are provided to assist people with e-commerce transactions.

iii. Brown Label ATMs:

These ATMs are non directly owned by a fiscal institution but are leased to provide ATM facilities in various places.

4. Orange Characterization ATMs:

These ATMs are used for all transactions related to the trading of shares.

5. Pink Characterization ATMs:

These ATMs are fabricated for utilise by women only.

6. Greenish Label ATMs:

These ATMs facilitate all transactions related to agriculture.

White Label ATMs:

These are gear up and operated past Non-Banking Financial Companies (NBFCs) and offer the most popular ATM services.

Xanthous Label ATMs:

These ATMs are provided to assist people with e-commerce transactions.

Brownish Label ATMs:

These ATMs are not direct owned past a financial institution but are leased to provide ATM facilities in various places.

Orange Label ATMs:

These ATMs are used for all transactions related to the trading of shares.

Pink Label ATMs:

These ATMs are fabricated for use by women only.

Green Label ATMs:

These ATMs facilitate all transactions related to agronomics.

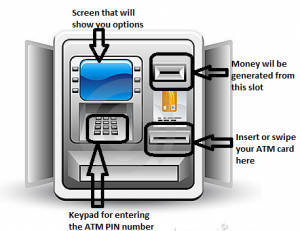

What is the structure of an ATM Machine?

The following parts make upwards the basic structure of an ATM machine –

- Display screen – This screen guides the transaction of the user by visually showing them the functions of the automobile, and helping them perform the task they need to.

- Card Reader – This is an input device that identifies your bank account on the footing of the card you feed into the reader.

- Cash Dispenser – This is the output device from where you tin can acquire the cash you have withdrawn through the machine.

- Receipt Printer – This is the indicate from where you will become the receipt of your transaction, after it is complete.

- Keypad – This is an input device that guides you through your transaction. Whatever you input through the keypad, volition be reflected on the display screen.

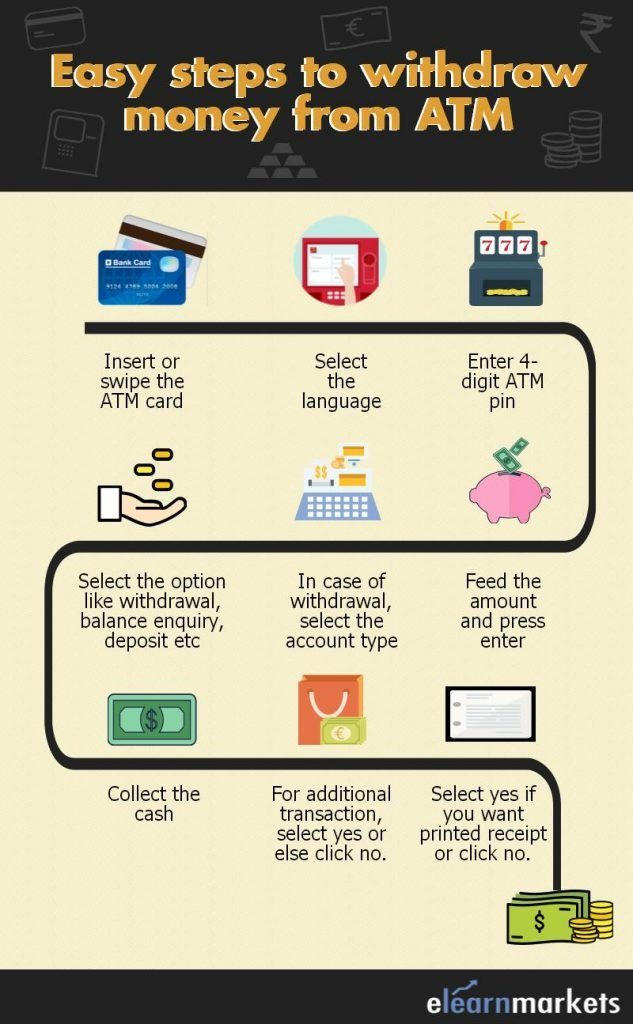

How to withdraw money from an ATM?

Permit us now look at the steps to withdraw money from an ATM.

Step 1: Insert ATM Carte:

Insert your ATM Card in the ATM auto in the slot equally marked in the above diagram.

Step 2: Select Linguistic communication

Select your language from the linguistic communication options appearing on the brandish screen (shown in the diagram above).

Step three: Enter 4-Digit ATM Pin:

Use the Keypad(every bit marked in the diagram) to enter your 4 digit ATM Pin Number.

Do not ever share your ATM Pin with anyone. Ensure that nobody is watching yous, while you enter the Pin.

Exist careful while inbound the Pin, as a wrong Pin may lead to the blockage of the ATM card.

Footstep 4: Select the type of Transaction:

On the ATM screen, you will exist able to see dissimilar types of transaction options such equally Deposit, Transfer, Withdrawal of Money, etc.

For cash withdrawal, you will have to select the Withdrawal Option.

Step 5: Select the Type of Account:

After selecting the cash withdrawal option, the screen will display dissimilar account types, select your business relationship blazon.

As an individual banker, y'all should exist choosing a savings account, equally current accounts are a special type of accounts used past businesses.

Some ATMs offer you a choice to add a line of credit to your account. This can help a broker when they need excessive money in an emergency.

Step six: Enter the withdrawal amount

Now, enter your withdrawal corporeality.

Brand sure that yous do not enter a withdrawal amount more than the balance in your account.

Now press enter.

Acquire the basics of banking in detail with Cyberbanking Awareness book for Beginners past Market Experts

Step 7: Collect the Cash:

Now collect the cash from the lower slot of the automobile (as shown in the picture above).

Step 8: Accept a printed receipt , if needed:

Later on you lot collect the cash, y'all will get an option of whatsoever you desire a printed receipt of the transaction. If you want a printed receipt, click yes and close the transaction.

Step 9: Another Transaction:

If you lot want to undertake some other transaction then select that option.

Withdrawals from an ATM card debit amount from any existing bank business relationship (either savings or current), and then when you lot wish to withdraw, ensure that you have sufficient balance in the business relationship.

Bottomline

When ATMs first came to India, people used to call them All Time Money or Any Time Money, and that is the biggest advantage of these machines. One is no more restricted to the bank's working hours to do basic transactions like drawing greenbacks or checking depository financial institution residue etc.

And the second biggest benefit is nowadays you tin withdraw cash from whatsoever banking company's ATM, need not be restricted to your specific bank's ATM.

Afterwards reading this commodity, I hope y'all are confident about how to withdraw money from ATMs and your adjacent visit will be hassle-costless. Ensure condom withdrawal and exercise remember to count your money and take the card out of the slot before leaving the ATM.

In guild to know more visit our website https://stockedge.com/.

Happy Reading!

Source: https://www.elearnmarkets.com/blog/how-to-withdraw-money-from-atm-machine/

Posted by: pillsburyourt1996.blogspot.com

0 Response to "Atm Should Extract Money From Checking Or?"

Post a Comment